It's a fact! The cryptocurrency market is going through a difficult period against the backdrop of a downward trend that is bound to last. And this situation affects all sectors linked to the new digital economy. But it is happening at very different and more or less painful levels, as in the case of NFT tokens. The latter, in fact, are falling from a (very) high level after the spectacular surge recorded in the last year.

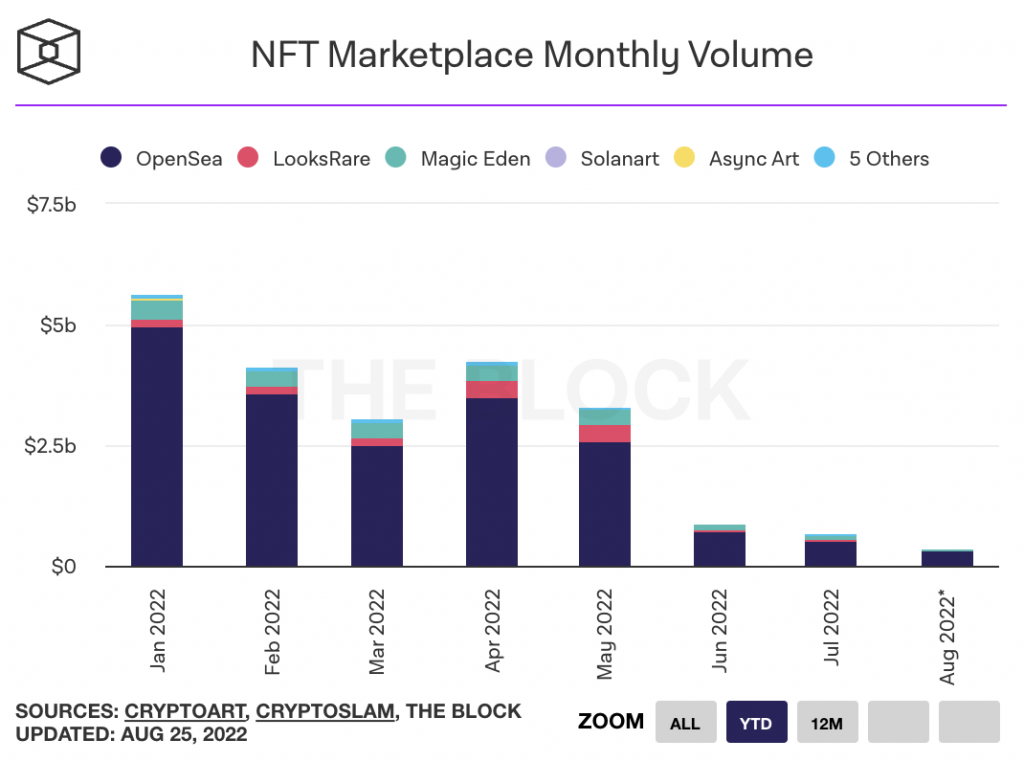

Everything was fine for the NFT sector, even at the beginning of 2022. A trend almost in contrast, given that the total amount spent by collectors in that period was already almost higher than that of the entire previous year. With an all-time high of monthly volumes recorded on its various platforms of over $ 5,6 billion in January. But that was before ...

Since then, the current crisis has actually reached this speculative bubble. With a very evident slowdown - to the limit of complete arrest - recorded since last June. For the first time since June 2021, the total monthly volume was less than $ 884,85 billion ($ 400 million). And this trend seems to continue, given that at the end of August this amount barely exceeds $ 369,7 million (XNUMX).

But don't worry, why the Opensea platform continues to impose a dominant position of over 80% on the entire ecosystem. Although just over a month ago he had to lay off 20% of his employees. At the same time, plan prices are plummeting for major collections like Bored Ape Yacht Club (BAYC) and CryptoPunks.

NFT - Strong gaming dominance

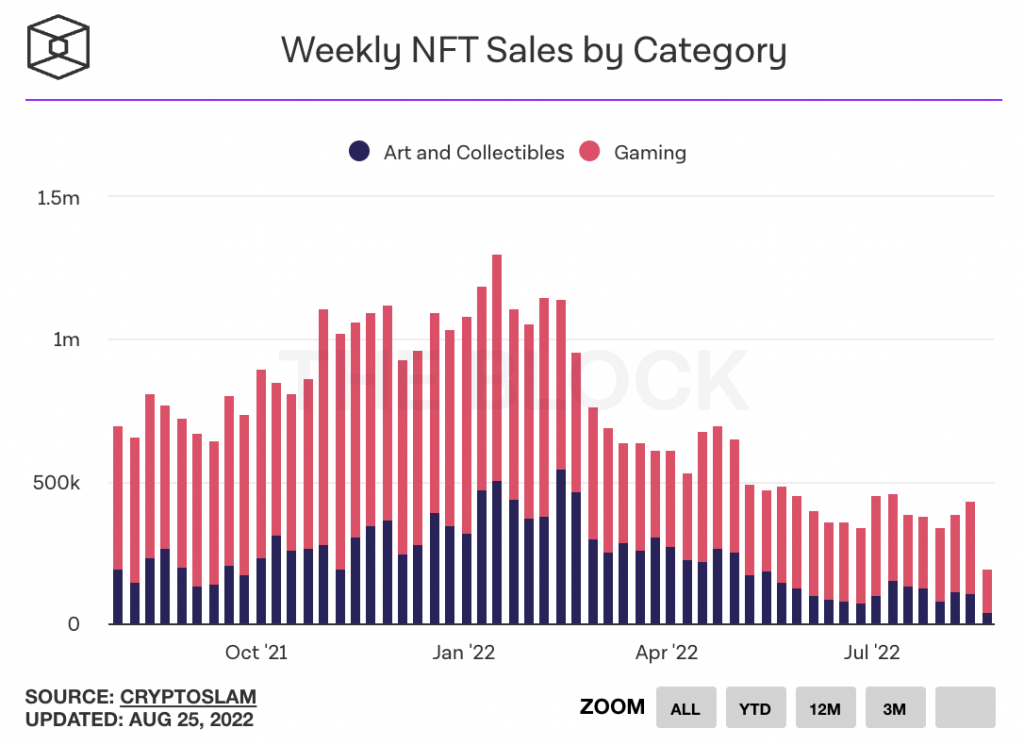

However, another dynamic emerges from the analysis of the NFT token industry. And it's about the new cryptogame trend. In fact, sales recorded in the field far exceed those of collectible NFTs, however the focus of all attention for their unlikely prices. At the point of accounting for over 75% of these transactions in recent weeks… And even for months.

And even though some blockchains are starting to stand out, it is clearly the Ethereum network that continues to concentrate the vast majority of activities in this sector. With no less than 80% of the transactions carried out for everything related to NFTs (cashing or gaming). And a share destined for the Solana (SOL) blockchain - second in the ranking in the sector -. from about 17% in May to just 4% in the last week.. Is this a collateral damage of its recent and numerous dysfunctions? The question deserves to be asked ...

A very evident downward trend in the NFT sector, with a significant slowdown in activity and volumes recorded. But that's just the general trend of the cryptocurrency market.. And that doesn't stop us from finding many innovative use cases for this digitally owned technology.