Contents

Launched in Italy in January 2022, the Commercial Republic is shaking the stock market investing landscape. This new broker provides access to stocks and ETFs from around the world, through its intuitive mobile application, without the fees usually charged by banks and brokers.

Beginner or experienced investors can open an account in under 8 minutes, with no minimum deposit and invest in 3 clicks.

Who is Trade Republic?

Trade Republic is an investment firm supervised by BaFin (the German financial regulator) which has been developing its technology infrastructure over the past 5 years.

Fintech has been offering its innovative brokerage services on the German market since May 2019 and on the Austrian market since the end of 2020.

Such was the success of its app for investing in stocks around the world without paying commissions that Trade Republic was voted "the best German bank for trading" in 2020 by the leading business newspaper Handelsblatt.

Based on this popularity and the € 62 million raised in 2020, the broker launched 2022 in Italy.

Trade Republic is licensed as a financial securities brokerage bank in Germany and is supervised by the Bundesbank and BaFin (the German financial regulator).

The high quality and security of its services are based on its proprietary banking technology and its cooperation with renowned partners such as HSBC and solarisBank.

Founded in 2015 by Christian Hecker, Thomas Pischke and Marco Cancellieri, the company's investors include Accel, Creandum, Founders Fund and Project A.

PEA or current account at Trade Republic?

For the time being, any account opening with Trade Republic can only be done within a securities account.

Important: as this broker is a foreign broker, you will have to report your Trade Republic account on your annual tax return ! Don't forget to avoid a fine of 1.500 euros! 😡

Trade Republic announces the imminent possibility of opening a PEA account (in 2022).

Honestly, I'm doubtful! As a reminder, DeGiro has been promising the same thing for 4 years and never delivered. 🙄

Any foreign broker who launches into France always makes this type of announcement to attract French investors.

But the complexity and regulatory constraints in France are such that the human, technical and financial costs of offering a PEA make me doubt Trade Republic's interest in offering PEA to the French.

In any case, for the moment, it is not possible to open a PEA account on Trade Republic!

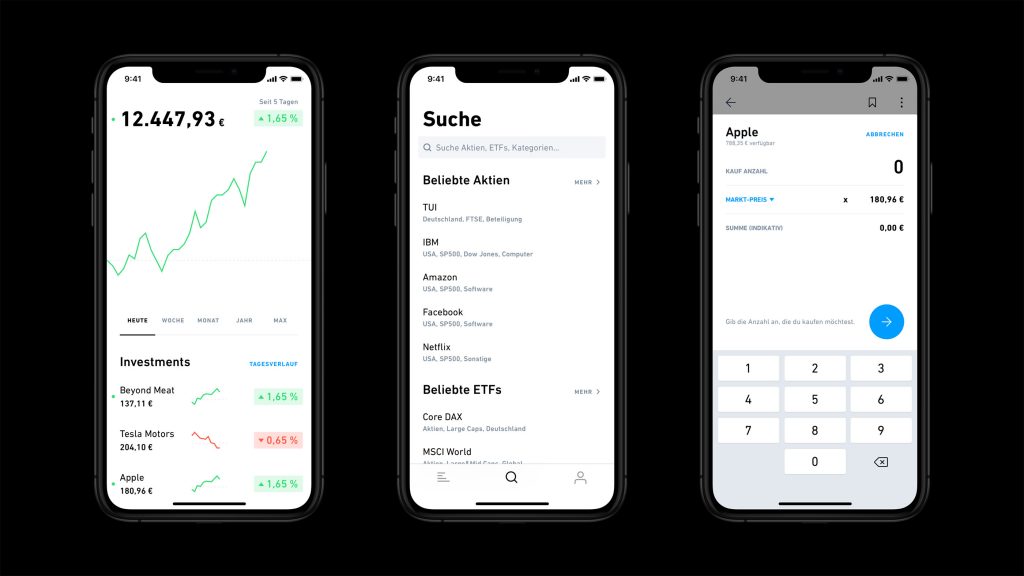

A fluid, complete and simple application

Trade Republic is a broker that is mainly available on mobile.

Updates From 2022, Trade Republic is also accessible from a computer via the web version. However, the web / internet version does not (yet) have all the features of the mobile version: it is only possible to enter orders (and account configuration / settings), in particular, the consultation of the account history is not available.

The application is very simple and functional. The application can be downloaded for free from both the Apple Store and the Google Play Store (for Android).

Registration is very easy. It only takes a few minutes. You must provide ID documents, which must be scanned from different angles.

Trade Republic promises it takes less than 8 minutes. It also took a little less time for me! 👍

You must then make a transfer to your Trade Republic account. From my Boursorama account it took less than 24 hours!

From July 2021, it is also possible to fund your Trade Republic account with a credit card. This is a significant advantage over other brokers.

The interface is simple and easy to use.

The search for securities (stocks or ETFs) is fast and comprehensive.

Fees: Trade Republic's brokerage fees are among the lowest

Trade Republic's technology allows you to automate and execute complex financial transactions in real time to provide an optimal customer experience and significantly reduce the costs of trading and holding financial securities.

These innovations allow Trade Republic to charge no commissions to its clients and offer transparent terms: there is no minimum investment, no downtime penalty, no custody fee and no premium exchange rate.

The fees are absolutely very low:

- 1 (one) euro per order (in case of partial executions, external fees are only charged once per trading day).

- 0 (zero) euro per purchase order in the case of a scheduled purchase (minimum 10 euros).

Attention: the sales order (even in the case of a scheduled purchase) has a cost of 1 euro.

Progressive investing is very easy to set up and can be changed and canceled at any time.

The maintenance of the securities account is also free.

It should be noted that exchange fees are kept to a minimum.

For charges, all currency conversions are made at the corresponding running rate for the currency sale (bid rate). For credits, they are made at the current rate corresponding to the purchase of currency (ask rate).

For Rates of the Commercial Republic These are probably some of the lowest on the market.

However, they are not the lowest in all cases: they can be found cheaper at Bourse Direct for small orders on the French market (€ 0,99) and also at DeGiro for US stocks for small orders (0,04% brokerage fees) and American equities (€ 0,5 + USD 0,04 / share).

However, Trade Republic clearly appears to be the cheapest for orders over around 500 euros (according to competing brokers), both on French and foreign stocks.

But the main point and the financial interest of Trade Republic, in my eyes, is his no exchange feesunlike most other brokers (even so called “free” ones like Trading 212 - see my Trading 212 review here).

A big positive for this broker for me that I mainly invest in the US. 👍👍

How does Trade Republic pay off?

With such low commissions, one can legitimately wonder how Trade Republic makes money (unless proven otherwise, the brokerage business is not crony and the investors are good Samaritans 😀).

Trade Republic makes money in two ways.

Firstly, like some so-called "free" brokers, Trade Republic makes money resell your stock exchange orders.

Your stock orders are transmitted, not to the "market" but to "high frequency traders" who earn a few cents on your stock order. And these "merchants" return part of their earnings to Trade Republic, as indicated in the general conditions of sale of the site: "Trade Republic also receives payments from third parties for the execution of securities orders (see section 4.2. Of the framework agreement)."

However, as the company told me, this compensation is on a "best execution" basis, as they are required to do by law. In other words, it does not mean that you are buying or selling your shares at a higher or lower price than what you would get with another broker. In this context, your buy / sell orders are always carried out at an optimized price (if you buy / sell European shares, you will always do so at a price equal to or better than that of the Euronext stock exchange).

Trade Republic's second remuneration method, which makes up the bulk of its income, is the commission paid by the issuers of ETFs / Trackers or funds (SICAV / FCP). When you buy these types of securities, Trade Republic receives a commission (like all brokers).

This remuneration is not exceptional (all brokers receive it) and is included in the performance of these securities (ETFs / Trackers or funds). Furthermore, the fact that Trade Republic references a large number of ETFs / Trackers rather than funds (SICAVs / FCPs) is part of the company's willingness to favor these products, which are more attractive to investors due to their fees. lower (and therefore less profitable for Trade Republic).

Access to the global market for stocks, ETFs and Turbos

Trade Republic offers access to:

- 7.500 shares from all over the world (of which almost 600 French women)

- 1 ETFs from Amundi, iShares, Lyxor, etc.

The app also offers real-time quotes and different types of orders accessible during extended market hours from 7:30 to 23:00.

Trade Republic regularly adds stocks that are available for trading.

For example, since August 2021, Trade Republic offers the possibility to buy / sell turbo to take up or down positions on stocks, indices, currencies and precious metals. This offer is available on a wide selection of HSBC turbos.

And placing an order is made as easy as possible. Just a few clicks.

There are 3 types of orders:

- Market orders

- Limit orders

- Arrest orders

What is the planned investment?

Trade Republic offers traditional savers the ability to create scheduled investment plans, starting at $ 10, to help them build long-term savings that are automatically invested in financial stocks of their choice.

It is possible to invest on a scheduled basis: 2 times a month, every month or every quarter.

You can choose to run at the beginning or in the middle of the month. It is very flexible indeed.

You then have access to:

- 2.500 shares (i.e. fewer shares available than in the case of a "classic" purchase)

- 1 ETFs

The planned investment also allows the purchase of fractions of shares or ETFs.

I am only sorry that this fractional share purchase feature is only for the purchase within the planned investment and not in the case of a simple purchase 😞!

Also note that to make scheduled purchases, you need to invest a minimum of 10 pounds (for fortnight, month or quarter).

Overall, this service is extremely simple and easy to set up.

My final take on Trade Republic

In the end, my opinion on this broker it is quite positive. 😍

What I like:

- Ease of registration and use

- The large number of stocks and ETFs available.

- Its very attractive rates, especially for high amounts. Trade Republic is one of the few brokers offering fixed prices per order (regardless of the order amount).

- No (or minimal) exchange fees, which makes it particularly competitive on the market!

- A “planned investment” offer that is particularly attractive in terms of brokerage fees (even if I don't use it). For those interested in this type of offer, Trade Republic is clearly well positioned on this point (especially in comparison to the broker Trading 212).

What could I regret:

- A more limited number of shares available in the planned investment offering.

- Higher prices in the simple ("classic") purchase of shares than in the planned investment.

- The purchase of fractional shares is only available in the scheduled investment offering.

In the end, we can only greet the arrival of this broker in France in 2021.

It brings a renewal and innovations that will convince many French people to invest in the stock market.

Personally, I have not chosen to leave my personal broker.

I still don't have enough experience with Trade Republic to leave my Lynx Broker broker.

If you want to understand why I stay with Lynx Broker, I'll explain here how to choose your broker correctly.

Open an account with Trade Republic

You can open a Trade Republic account only using your mobile phone (with the application available on the App Store or Google Play).

To open an account with Trade Republic click here.

By opening your account through this referral link, you will get 15 € for free from Trade Republiccredited after your first purchase (I will also benefit from the same offer).

👉 Take advantage of these € 15 credited to your account clicking here !

FAQ

Trade Republic announces the imminent availability of PEA investments. However, it is not currently possible to open a PEA in Trade Republic. What I think about this PEA announcement is explained here.

Trade Republic is one of the cheapest French brokers. However, this depends on the size of your order and the type of shares you buy / sell. Here is my comparison of brokerage fees.