Although the event already appears to be classified as a historical fact in the cryptocurrency ecosystem, the collapse of Earth has not finished shaking the different sectors. A cataclysm whose shock wave could still cause violent aftershocks in the months to come. With a decidedly unequal impact depending on the areas concerned. All this according to a principle summarized with the very explicit term of "crypto-contagion". But, after almost three months of chronic instability, it seems more than the time has come to take stock of this misadventure. An exercise that DappRadar has undertaken in his latest report entitled: "The adoption of cryptocurrencies after the collapse of the Earth and its contagion". A nice program ...

Regardless of how you think about it, the case of the Earth (LUNA) disaster is already an integral part of the short history of the cryptocurrency industry. So much so that some have compared it to the equally spectacular and dramatic bankruptcy of the banking giant Lehman Brothers in 2008.. The direct consequence was a global economic crisis, which led to the birth of Bitcoin. And in this case, the sudden and permanent loss of about $ 40 billion.

A turning point that can be clearly defined as a border between a "before" and an "after". And the repercussions are far from identical for all sectors of this young digital economy and its derivative markets.. This is a very informative observation in the midst of a downtrend, but in the midst of a technical rebound attempt in the summer. In fact, according to the report delivered by the DappRadar structure, this "blow has exerted a great deal of pressure on the entire cryptocurrency market". And not all collateral victims are necessarily to be pitied ...

DeFi and NFT - Great collateral damage

In its latest report, the DappRadar facility does a difficult but necessary job. That is, to identify and list the possible and visible consequences of the collapse of the Earth ecosystem, which occurred a few months ago. This is to measure the extent of this historic cataclysm. But also the resilience of the various sectors of this digital economy, in the face of the violence propagated by this unprecedented shock wave.. And the least we can say is that not all sectors are suffering the same damage. To the extent that some of them are doing (very) well ...

" The collapse of Terra - the second largest DeFi ecosystem at the time - in May wiped out some $ 40 billion in venture capital and retail money. The blow took a toll on the entire cryptocurrency market. Starting with Bitcoin and Ethereum, which had a ripple effect on the rest of the industry, also known as cryptocurrency contagion. As a result, several parts were hit, with 3AC, BlockFi and Celsius in the spotlight.. "

DappRadar

Indeed, according to the figures presented by DappRadar, DeFi would undoubtedly be the big loser of this crisis. The overall number of transactions - the measure at the heart of this analysis - decreased by 14,8% compared to last May.. This even if "the overall activity of the blockchain remains relatively flat, with a 1% drop in the total number of transactions compared to the first quarter". With cascading failures, as in the cases of Celsius, BlockFi or, more recently, the venture capital structure Three Arrows Capital (3AC).

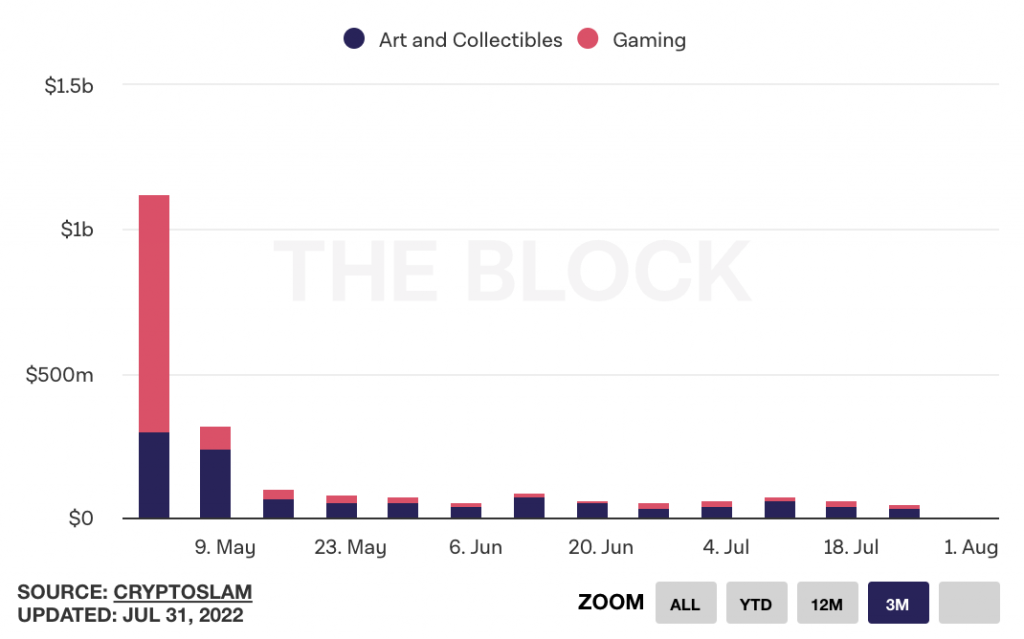

With a more moderate decline for the NFTS sector, of “only” 12,2% in the same period. But a market in which trading volumes fell by 67% in the month of May alone. This is the largest decline since the record increase in 2021.

Metaver and crypto-game - It's not bad either

However, the situation plotted by DappRadar has not only negative points. In fact, some industries are doing much better than DeFi and NFT. And this is especially true of the new trend, the metaverse.. These virtual universes are torn between Meta's ferocious centralized appetite and the more Web3 ambitions of established players in the cryptocurrency ecosystem. With a 97% increase in NFT projects related to the metaverse from the second quarter. But also the crypto-game, currently very fashionable despite persistent opposition from some players. This "while recording increases of 27% and 9,51% each". that clearly dwarf the competition by swimming underwater.

" Gaming transactions on Blockchain have challenged the bear market and are up 9,51% from the first quarter. Investments in games and metaverse projects remain steady with $ 2,5 billion invested in the first and second quarters."

DappRadar

With a special mention to the crypto-game theme. Because even with a 7% drop in the average amount of Unique Active Wallet (UAW) assets, players continue to engage with their favorite games. And this "more or less at the same pace as before the Earth accident". A commitment not to be taken lightly, because it could counteract some effects of volatility “thanks to the non-speculative aspects of the games themselves”. A trend verified in July, according to data from DappRadar.

" This bullish activity indicates that the commitment to virtual worlds is not based on their profitability for the end user. This shows that virtual worlds are inherently fun for the end user, as communities remain active despite the devaluation of native tokens."

DappRadar

A report by DappRadar highlights the continued success of the Axie Infinity game (AXS, SLP), whose NFT collection is "the most sought after in 112 countries". And significant institutional investments in blockchain and metaverse gaming that underline the motivation of large companies in the sector. Ecosystems that sometimes intertwine too quickly, but which represent a “high growth potential in the future”.

Thanks for your blog, nice to read. Don't stop.

In all your gettings, get wisdom.

I used to be more than happy to find this web-site. I wished to thanks in your time for this glorious learn!! I undoubtedly enjoying every little bit of it and I've you bookmarked to check out new stuff you blog post.