Contents

CEX.io is one of the most established exchanges in the cryptocurrency industry and dates back to 2013. The exchange was primarily concerned with allowing its users to make purchases of Bitcoin, and now allows anyone who signs up to easily purchase cryptocurrencies such as Bitcoin Cash as well. , Ethereum, Litecoin and XRP.

The exchange supports a variety of currencies and payment options, and CEX.io is well known for facilitating credit and debit card transactions at a relatively low cost.

Designed to serve both novice and experienced buyers / traders, CEX.io now offers the ability to trade Bitcoin on margin and the platform is also accessible via the website, mobile application, WebSocket and Rest API.

Read on for our full bag review, we've rounded up everything you need to know if you're thinking of using it.

Visit CEX

What is CEX.io?

CEX.IO LTD was launched in November 2013 and started out as a Bitcoin cloud mining and exchange service. Mining services were shut down in 2015 and the team focused solely on running a cryptocurrency exchange.

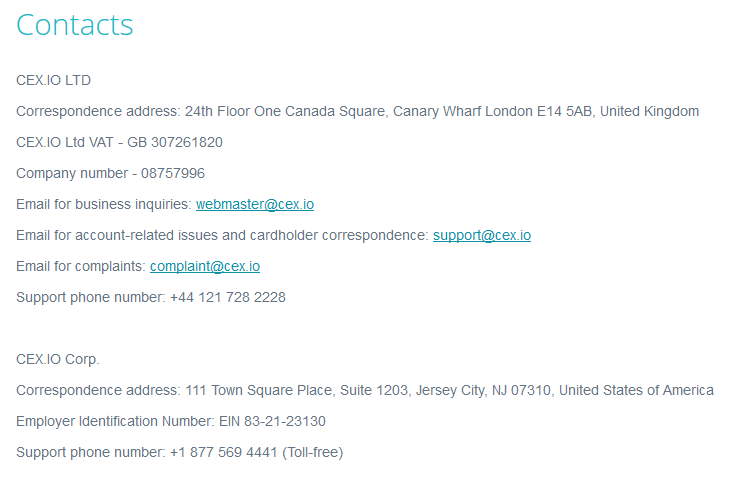

Based in the UK, CEX.IO LTD has a correspondence address of 24th Floor One Canada Square, Canary Wharf London E14 5AB, UK and a UK VAT number of GB 307261820.

The exchange also operates as a registered entity in the United States, which allows it to provide services in 31 American states. CEX.IO Corp has a correspondence address at 111 Town Square Place, Suite 1203, Jersey City, NJ 07310, USA and Employer Identification Number (EIN) 83-21-23130.

Being registered with the ICO in the UK and FINCEN in the US, the exchange is well respected and anyone who signs up can trade in USD, EUR, GBP and RUB, as well as cryptocurrencies such as BTC, ETH, LTC and USDT.

User accounts can also be funded by wire and bank transfers or by using a Visa / MasterCard credit card.

The exchange aims to make buying and trading cryptocurrencies as easy as possible and combines an easy-to-use interface, state-of-the-art security protocols, and extensive customer service for all of its users.

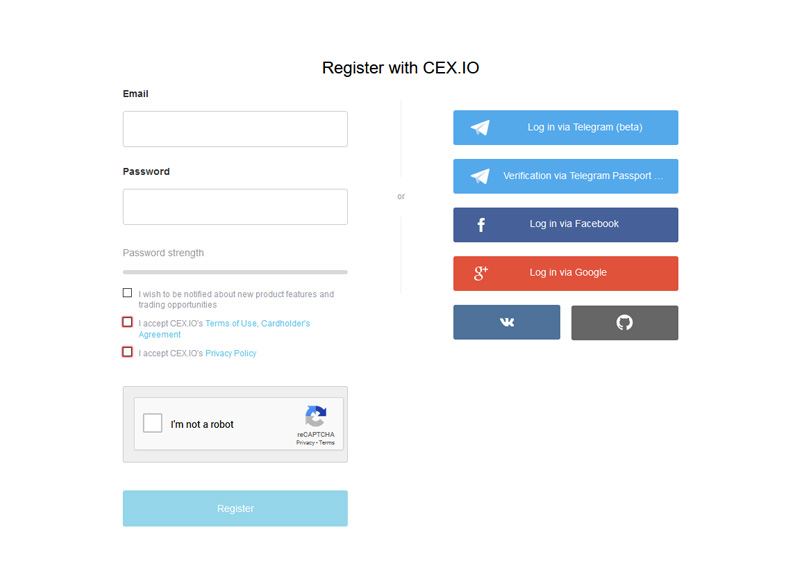

To open an account

Opening an account with CEX.io involves registering by providing an email and setting a password; The exchange operates a number of account levels and various services require further account verification and submission of personal information including address, telephone number and related supporting documentation.

Account types and limits CEX.io

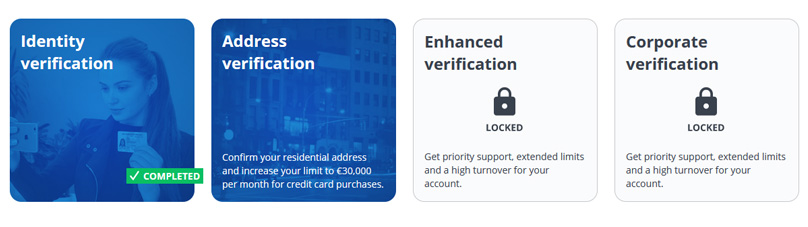

Four different account levels are available on CEX.io, all with different purchase limits based on the amount of verification provided.

The four levels of account verification are as follows:

- Identity

- Address

- Enhanced

- Aziendale

Level identity

The Identity tier allows users to quickly purchase Bitcoin using a credit card and providing basic verification with a supporting ID.

Accounts are limited to deposits / withdrawals up to 1000 USD / EUR (800 GBP) per day and 3000 USD / EUR (2000 GBP) per month.

This level also cannot use SWIFT or ACH bank transfers.

Address verification level

The address verification level allows for unlimited total deposits via wire transfers, although they are limited to 200.000 USD / EUR / GBP per day and 500.000 USD / EUR / GBP per month.

Credit card deposits are limited to 3000 USD / EUR (2000 GBP) per day and 30.000 USD / EUR (20.000 GBP) per month, while withdrawals are subject to 200.000 USD / EUR / GBP per day and 500.000 USD / EUR / GBP per month.

Advanced verification level

The Enhanced verification level requires a selfie and a bank statement and has no limits on bank deposits, but credit card deposits are limited to 10.000 USD / EUR (8.000 GBP) per day and 100.000 USD / EUR (80.000 GBP) ) per month.

While SEPA, ACH and Faster Payments withdrawals are unlimited, withdrawals made via SWIFT are subject to limits of 200.000 USD / EUR / GBP per day and 1.000.000 USD / EUR / GBP per month.

Business level

Corporate accounts require business documents in addition to selfies and include the same features as the account level with advanced verification, namely unlimited bank deposits and unlimited SEPA, ACH and Faster Payments withdrawals.

Funding an account

You can deposit funds into your account in various ways and in different fiat currencies, namely US dollar (USD), euro (EUR), British pound (GBP) and Russian ruble (RUB).

Deposits can be made by bank transfer and / or credit and debit cards and deposit payments are processed instantly.

However, in all countries where card payments are supported, only three successful daily transactions are allowed for each verified payment card.

Deposits made via payment cards with a local currency other than USD, EUR, GBP or RUB will be automatically converted to the selected deposit currency.

The exchange rate and any fees associated with the transaction are calculated and deducted by the card issuer.

Users can also deposit supported cryptocurrencies by clicking the "Deposit" button and sending the funds to the unique exchange account address for each digital asset.

The process is the same as sending cryptocurrencies to any other exchange, and cryptocurrencies, including BTC, ETH, LTC and XRP, can easily be deposited into your exchange account.

Account verification

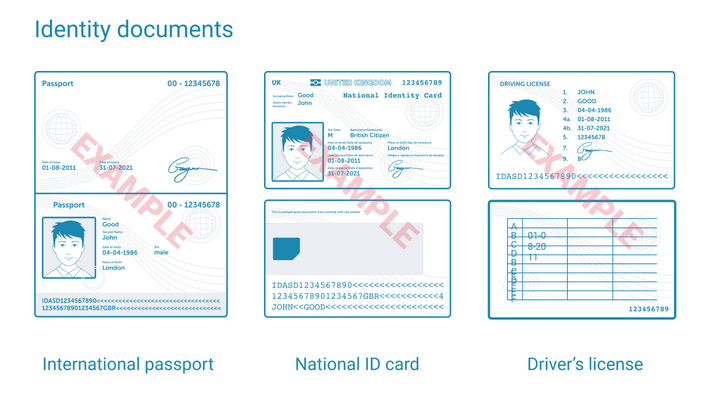

Before starting the verification process, the CEX team recommends preparing the following documents:

- International passport / national identity card / driving license. This document must be valid and internationally recognized. It must also be issued in Latin characters or with the Latin transliteration of the main fields.

- A sheet of paper and a pen.

- Your social security number (or social security number if you are a resident of the United States).

You'll also need to take and upload photos and scan documents, so having a camera or cell phone handy is another requirement.

The process can be divided into the following stages:

Step 1 Verification of identity

It is necessary to provide the following data:

- Personal information (name, gender, date of birth, place of birth and country of residence)

- An official government-issued ID (passport, driver's license, ID card).

- A selfie and a note written with you holding an identity document

Your social media profiles are an optional addition that can be submitted to speed up the verification process.

After submitting the necessary information, you will need to photograph your ID documents and upload them before taking a selfie holding your ID along with a handwritten note that contains “I am a CEX.IO customer, current date , signature".

Step 2 Verify the address

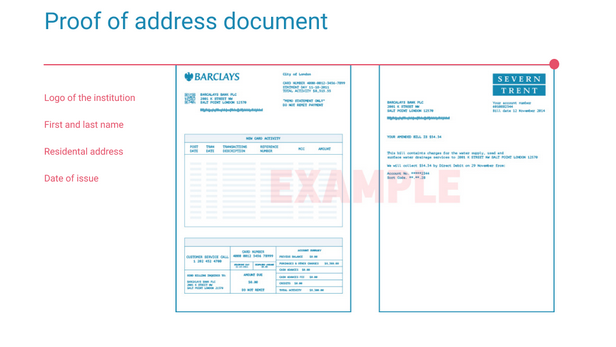

Here you need to provide:

- The country of residence and address

- Proof of residence (bank statement / electricity bill)

The two main requirements are that the document must be in Latin characters or with Latin transliteration and that it must contain the credentials of the institution (for example the logo), your name and surname and your residential address on a single page.

Again, you need to take a photo or scan the proof of address documents and upload them. You can also scan the QR code on the screen with your smartphone and take a photo with your mobile to speed up the process.

Phase 3 Advanced and corporate verification

This phase is intended for anyone opening or switching to an Enhanced or Corporate account and requires the provision of additional information such as official business documents and financial statements.

The whole process doesn't take long, however final approval takes days. The team demonstrates the process they are available to resolve any issues.

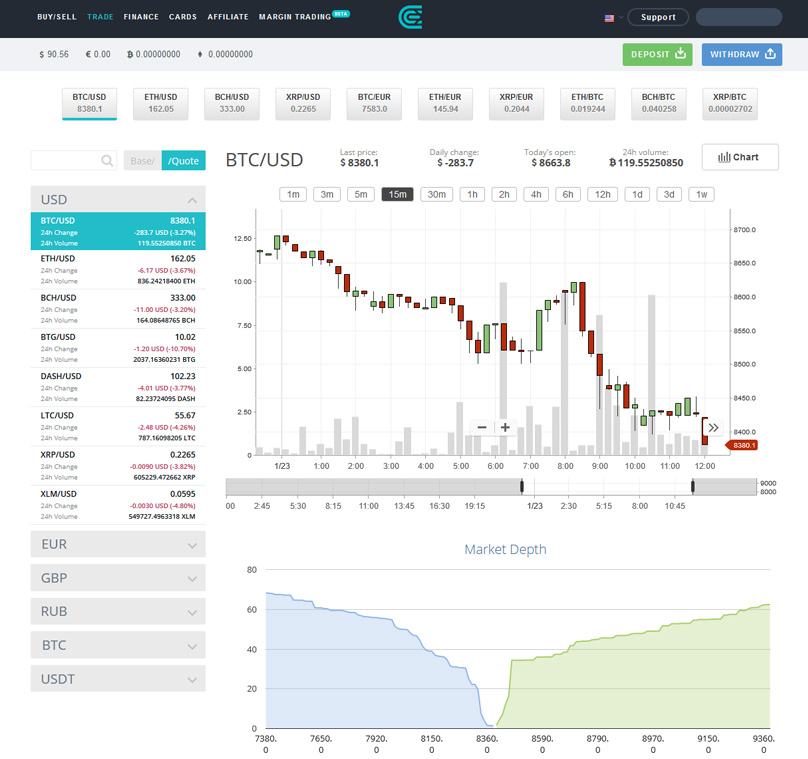

What exactly can be traded on CEX.io?

The exchange currently supports the buying, selling and trading of over 15 cryptocurrencies, as well as the use of multiple fiat currencies.

However, several cryptocurrencies and / or buying and trading pairs are only available when using certain CEX services.

The currencies available on the platform are the following:

- Supported fiat currencies: US Dollars (USD), Euros (EUR), British Pounds (GBP) and Russian Rubles (RUB).

- Instant purchase of cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Bitcoin Gold (BTG), Dash (DASH), Litecoin (LTC), Ripple (XRP) Stellar (XLM) Tron (TRX), BitTorrent Token (BTT) and MetaHash (MHC).

- Each of the listed digital currencies can be purchased with USD, EUR, GBP and RUB.

- Cryptocurrency trading: Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Bitcoin Gold (BTG), Dash (DASH), Litecoin (LTC), Ripple (XRP) Stellar (XLM) Tron (TRX), BitTorrent Token (BTT), MetaHash (MHC), Cardano (ADA), OmiseGO (OMG), Ontology (ONT), Ontology Gas (ONG), Gemini Dollar (GUSD) and Tether (USDT).

- All listed cryptocurrencies can be traded using USD and EUR trading pairs, while there are currently nearly 13 trading pairs with BTC.

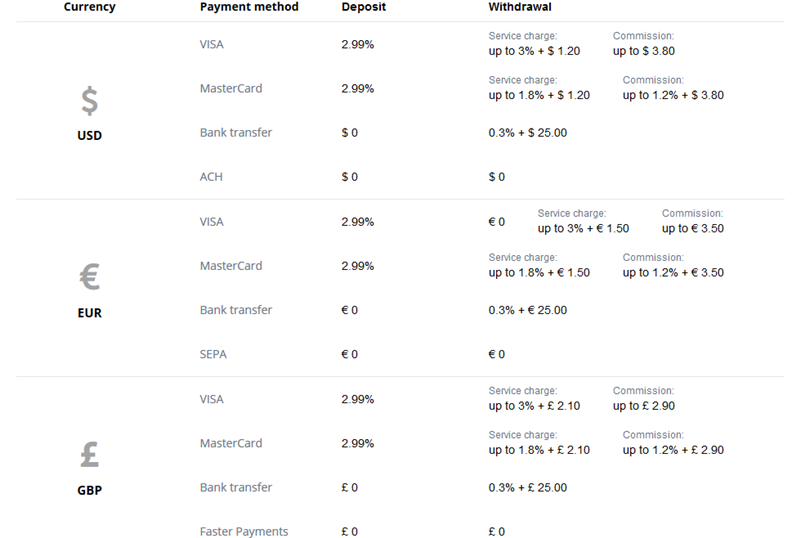

Commissions and expenses on CEX.io

CEX.io aims to operate as a platform at relatively low fees and there are no fees for deposits in USD, EUR or GBP via wire transfer, be it ACH, SEPA or Faster Payments.

- Withdrawals via wire transfer carry a 0,3% service fee plus a standard fee of $ 25 / € 25 / £ 25 depending on the currency used, however withdrawals made via ACH, SEPA or Faster Payments are free.

- Visa / MasterCard deposits in USD, EUR, GBP or RUB carry a 2,99% fee, while USD withdrawals on Visa card carry a service fee of up to 3% + USD 1,20 and a fee of up to at $ 3,80. Visa card withdrawals in euros have a service fee of up to 3% + € 1,50 and a fee of up to € 3,50, while withdrawals in GBP have a service fee of up to 3% + £ 2,10 and a commission of up to £ 2,90.

- Withdrawals in USD to MasterCard carry a service fee of up to 1,8% + $ 1,20 and a fee of up to 1,2% + $ 3,80. Withdrawals with MasterCard in euros carry a service fee of up to 1,8% + € 1,50 and a fee of up to 1,2% + € 3,50, while withdrawals in GBP carry a service fee of up to at 1,8% + £ 2,10 and a commission of up to 1,2% + £ 2,90. Withdrawals with Visa and MasterCard made in Russian Rubles carry a standard fee of 3% + 50 RUB.

Transaction fees

CEX.io applies the following commission schedule for makers and traders with 30 day trading volume based transaction fees for all pairs. This is recalculated every day at 00:00 (GMT) and includes the current day's transactions.

| Trade volume 30 days, BTC | exchanger | Creator |

| ≤ 5 | 0.25% | 0.16% |

| ≤ 30 | 0.23% | 0.15% |

| ≤ 50 | 0.21% | 0.13% |

| ≤ 100 | 0.20% | 0.12% |

| ≤ 200 | 0.18% | 0.10% |

| ≤ 1000 | 0.15% | 0.08% |

| ≤ 3000 | 0.13% | 0.04% |

| ≤ 6000 | 0.11% | 0.00% |

| > 6000 | 0.10% | 0.00% |

Countries supported

Countries where card payments are not available:

Afghanistan, Bosnia and Herzegovina, Bangladesh, Bolivia, Burundi, Democratic Republic of Congo, Central African Republic, Cuba, Algeria, Ecuador, Ethiopia, Iraq, Iran, Iceland, Cambodia, North Korea, Laos, Lebanon, Libya, Morocco, Nepal, Pakistan, Somalia, South Sudan, Sudan, Syria, Uganda, Vietnam, Vanuatu, Yemen, Zimbabwe.

Countries where SWIFT payments are not available:

Afghanistan, Bosnia-Herzegovina, Burundi, Democratic Republic of Congo, Central African Republic, Ivory Coast, Cuba, Eritrea, Ethiopia, Guinea, Guinea-Bissau, Haiti, Iran, Iraq, Kenya, North Korea, Laos, Lebanon, Liberia , Libya, Nigeria, São Tomé and Príncipe, Somalia, South Sudan, Sudan, Syria, Tanzania, Tunisia, Uganda, Vietnam, Vanuatu, Yemen, Zimbabwe.

Additionally, MasterCard withdrawals for Indian users are disabled, while ACH payments are only supported for US residents.

The exchange currently serves 31 U.S. states and has obtained money transfer licenses in 15 states, including Alaska, Florida, Georgia, Iowa, Kansas, Maryland, New Hampshire, New Jersey, New Mexico, Oklahoma, Oregon, Rhode Island, South Dakota, Vermont and West Virginia.

CEX.io also operates in the following 16 states that do not require a license for exchanges as senders of money:

Arkansas, California, Colorado, Indiana, Kentucky, Massachusetts, Michigan, Missouri, Montana, Mississippi, North Dakota, Pennsylvania, Utah, Virginia, Wisconsin and Wyoming.

How suitable is CEX.io for beginners?

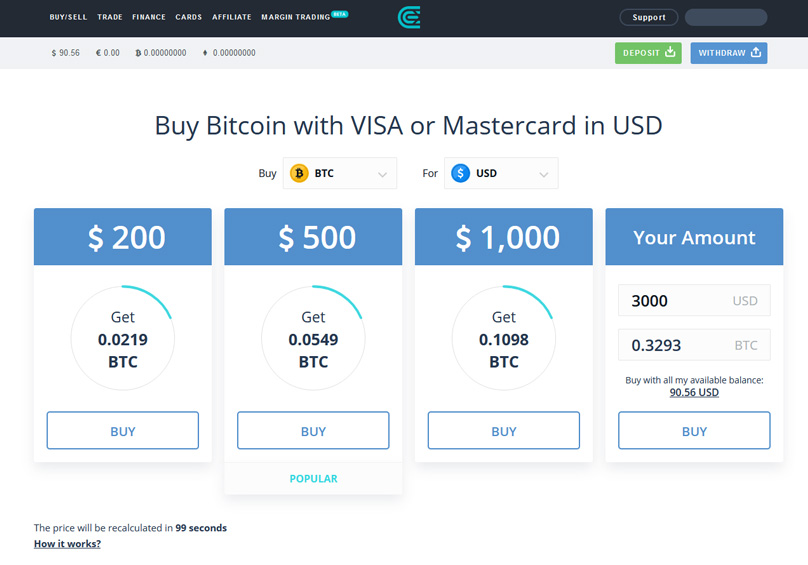

Since CEX started its business in 2013 as a place to easily buy Bitcoin, the exchange still makes buying Bitcoin easy and maintains an instant purchase feature.

Here, anyone can select the cryptocurrency they want to buy and the fiat currency they want to use to complete the purchase. After entering the amounts, credit card details and verification details, you will receive the coins.

The website is generally well designed and the trading interface is easy to use, with the entire platform aiming to be user-friendly.

As you might expect, the exchange offers a support system that allows anyone to submit inquiries, and the team can be contacted by email or phone, as well as through various social media channels.

There is also an extensive FAQ section covering the most common questions related to accounts, finance and trading, while the official blog covers a variety of topics and news articles.

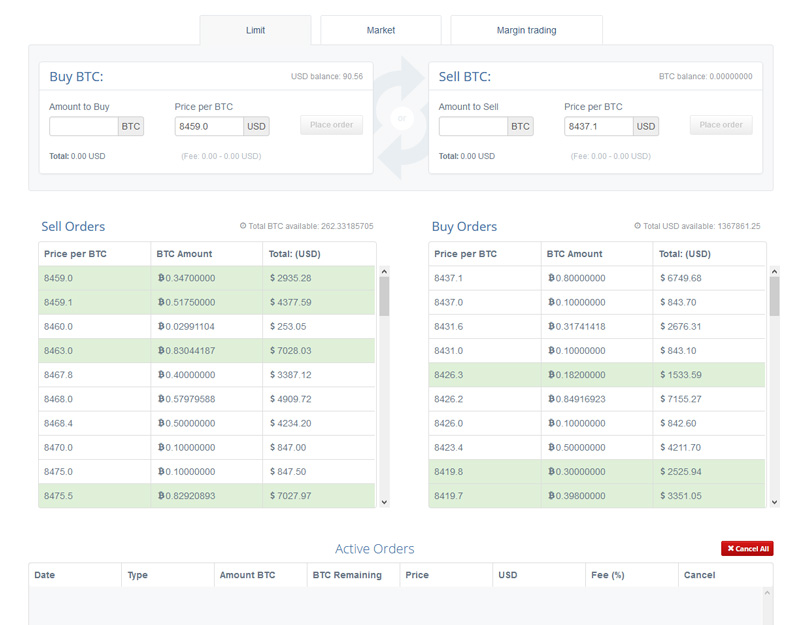

More experienced users can take advantage of CEX.io's trading platform, which incorporates all the usual features.

These include market orders and limit orders, extended charts and technical indicators, as well as advanced reporting and cross-platform trading (via mobile app and / or API).

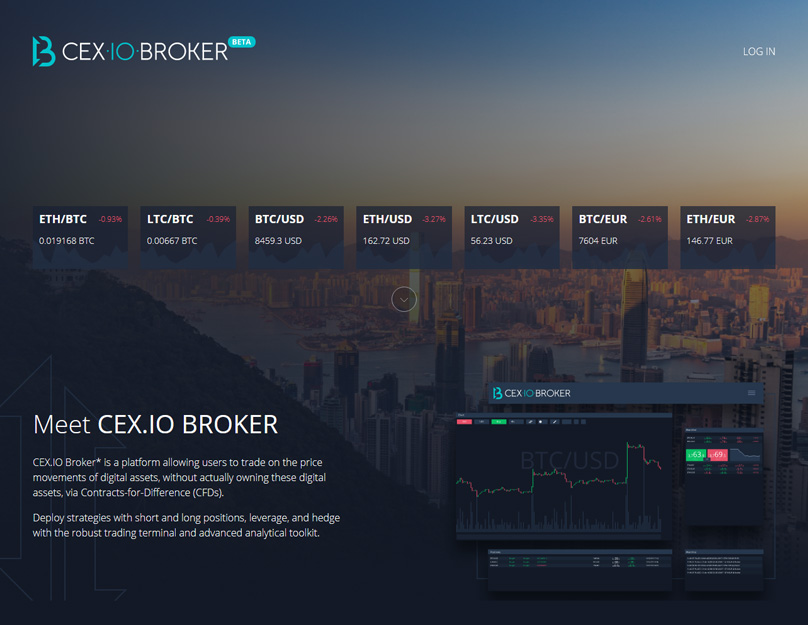

Margin trading is also available for more experienced traders, although this service has moved from the CEX.io trading platform to a dedicated margin trading service called CEX.io Broker.

This new service specifically targets margin traders and offers advanced trading tools and a full range of technical analysis tools.

As expected, the service also allows trading on margin through CFDs (Contracts for Difference), as well as greater trading (and risk) possibilities thanks to the use of up to 10x leverage.

Consequently, CEX is a viable option for anyone looking for an easy way to buy cryptocurrencies and for more experienced cryptocurrency traders; however, there are some complaints online regarding the exchange's customer support response times and extensive verification process for higher account levels.

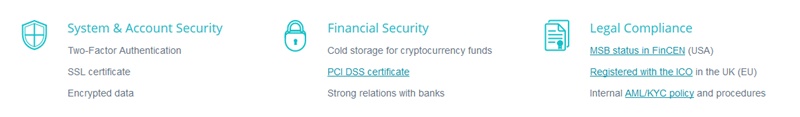

Is CEX.io safe?

CEX has a good reputation when it comes to security and suffered a hacking incident in 2013 when the exchange was just getting started. The vulnerability was patched shortly thereafter and the exchange has not experienced any security breaches since then.

The CEX team uses a number of security protocols, including protection against DDoS attacks, full data encryption, offline cold storage, and two-factor authentication (2FA).

User accounts must have 2FA enabled to make a withdrawal and the mobile application allows you to set up a withdrawal pin code (WPC) to confirm mobile withdrawals.

The digital assets held by the exchange are spread across hot and cold wallets, and there are hot and cold wallets with separate private keys for each digital currency. Furthermore, only a small percentage of all digital assets in circulation are stored in hot wallets, which helps protect funds from bad guys.

The team also incorporates physical segregation, encryption and rigorous access controls, including 24/24 surveillance, alarm systems and secure safes to further enhance the security of funds held by the exchange.

Client fiat funds are held in deposit accounts with the exchange's banking partners and these fiat funds are kept separate from the company's accounts, which means that only clients are eligible for these funds.

Additionally, only authorized persons can initiate transactions with client fiat held in bank accounts, and the exchange subjects its employees to a rigorous background check process.

For customers based in the United States, their USD funds are covered by FDIC insurance, up to a maximum of $ 250.000 per person.

The team respects the banking / financial regulations in force and takes care of the KYC / AML verification for all users; in addition, the exchange uses an “expert system” that continuously monitors all digital asset transactions to identify any irregular activity.

Verification of the account requires a personal identification document, a scan of the documentation relating to the address and a photo of the user holding their identity document or credit card; Additionally, CEX maintains Level 1 PCI DSS compliance.

This is the highest level of compliance and ensures that every merchant, processing over 6 million Visa transactions per year, stores, transmits or processes credit card data to the highest standards and maintains a highly secure environment.

As a result, CEX is a highly transparent operator, maintains high security standards and is registered with the ICO in the UK and FINCEN in the US. The team is quite open to its security protocols and legal framework and for more information, you can consult the site , here, and , here.

Conclusion

CEX.io is an established operator, present on the market since 2013, and the exchange is also one of the most transparent in operation.

Registering with the FCA in the UK and FINCEN in the US contributes significantly to trust, as does the fact that funds are covered by FDIC insurance, up to a maximum of $ 250.000 per person for US users.

The instant purchase feature is a big plus for anyone looking for an easy way to buy cryptocurrencies, and CEX.io is one of the few exchanges that supports credit card and fiat purchases, while also allowing users to deposit and withdraw funds. in four different fiat currencies.

Experienced traders are also well served, as the trading platform offers the full range of standard order types and functions, as well as technical analysis tools.

CEX also generates significant liquidity levels and offers trading margin with leverage of up to 10x, benefiting the most adventurous and experienced traders.

There are some complaints circulating online regarding customer service and fees, however the exchange is generally transparent in terms of pricing and it is worth looking into the company's commission plan before making any purchases or trades on the platform to make sure that the expenses correspond to your needs.

Overall, CEX.io offers a relatively easy-to-use service, with support in a wide range of countries, and allows anyone to purchase Bitcoin and other cryptocurrencies with minimal effort.

While the verification process may be a stumbling block for some, for anyone looking for an easy way to buy cryptocurrencies using traditional banking methods, CEX.io is a viable option.

The same goes for anyone interested in trading on margin and buying cryptocurrency CFDs. While this form of trading increases risk exposure, it also allows traders to maximize their profits and margin traders may find commissions and services advantageous over other platforms that leverage margin trading.

Visit CEX