Contents

This technical analysis will be an opportunity to take a long-term look at Bitcoin. The goal is to determine as accurately as possible when the next bull market could startbased on available historical data. We will then analyze the short-term trend of BTC. Given that the current period is especially favorable for implementing an active trading strategy very profitable for those who know how to read the various indicators and decipher the signals.

Full video of this analysis cryptotrader at the end of the article.

Bitcoin – When is the next bull market?

In monthly time units, BTC is in a situation quite similar to previous years. With the help of the various data shown in the graph below, the goal is to determine when the next Bitcoin cycle should start. This is a rather elementary analysis, but necessary to understand the past and the future.

These different figures were first and foremost drawn on the 2013 bull cycle. With a red rectangle starting top left on the local top and closing on the next bull market buy signal. Then a green rectangle that starts in the lower left on the local bottom and also closes on the buy signal. Finally, a blue ellipse that matches the buy zone which should be the start of any bull market.. These digits are then transferred identically to subsequent cycles.

Bitcoin – A good time for active trading

And if the data highlighted by the red rectangle bodes well, the end of the current bear cycle is not expected before the second half of 2024.. A term that should be validated by a new set of successive bullish candles to kick off this run. However, this does not necessarily mean that Bitcoin will decline or stagnate during this period.

As for the green rectangle, its term appears this time around April 2024. A period that exactly coincides with the upcoming Bitcoin halving (marked by dashed yellow lines), currently estimated as of 8 April. A halving of miner rewards that triggers a significant increase in BTC every time.

And finally, the blue ellipsis seems to indicate the start of a bull market a year later. Following the postponement of these various figures, the estimated starting line is placed in the area between April and June 2024. BTC could continue to trade in a range between $20.000 and $50.000 or more until then.

Be that as it may, this type of period is particularly favorable for cryptocurrency trading to profit from the various volatility movements that will occur. But this only if you know the tricks of the trade, in order to limit the risks and optimize each position taken. And that's exactly what the automated trading service developed by CryptoTradercurrently accompanied by the formula RARE: Profitability guaranteed or refunded !

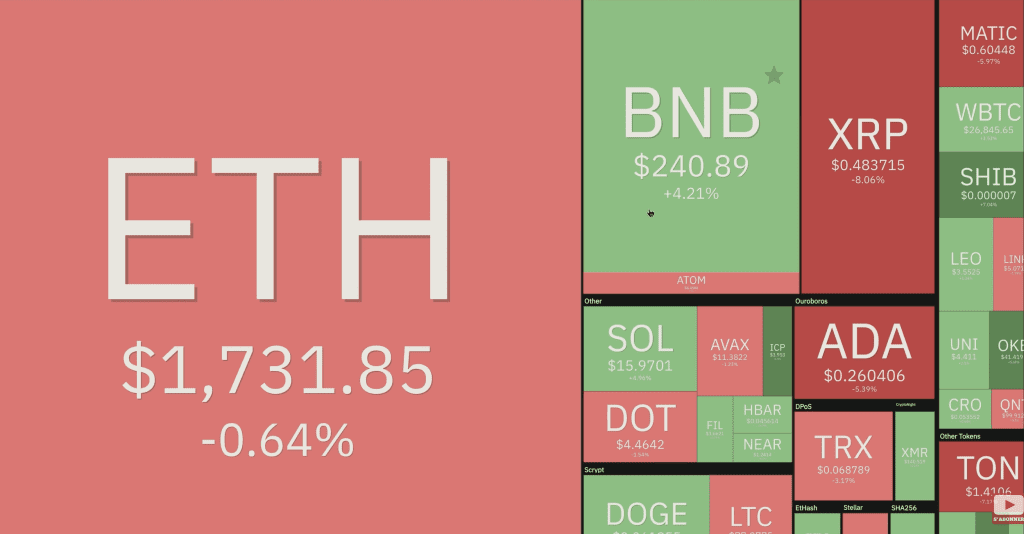

Cryptocurrencies – A totally neutral market

Currently, the cryptocurrency market trend over the last week has clearly been towards neutrality. The situation in the last 30 days is more complicated, as only large-cap projects are resisting the -20% drop recorded on average over this period.

In fact, some alkoin have returned to all-time lows, while others are still flirting with major support levels. For this reason, the only real positions worth taking at the moment are mainly those on Bitcoin and Ethereum, in order to limit the damage as much as possible. For the cryptocurrency market remains down , destined to last for some time yet.

Bitcoin – Explosive Upside Potential

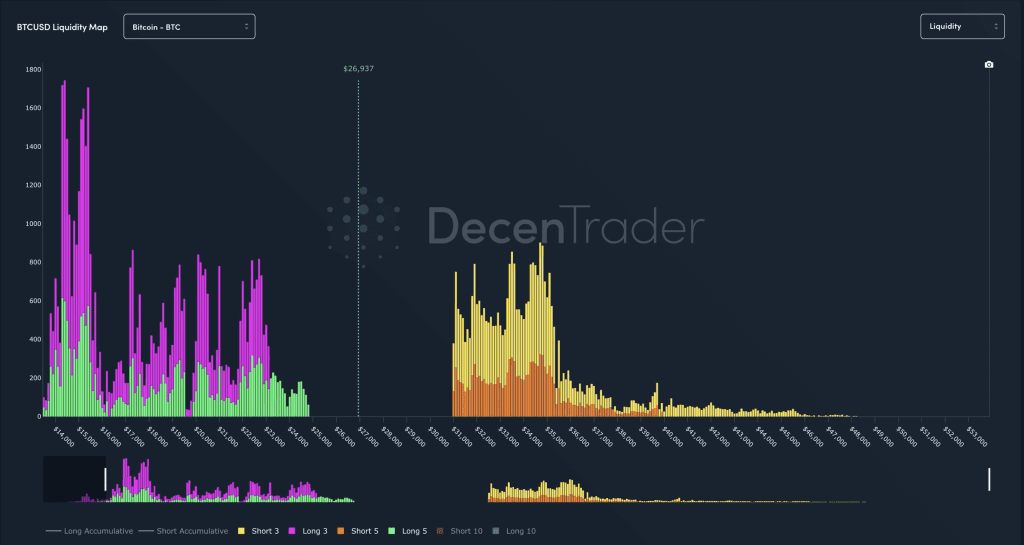

In the Bitcoin liquidity map, there is a complete lack of liquidity between the $25.000 and $31.000 levels. This is quite logical, since no one has an interest in placing a short or long order within the range where BTC is currently trading.

Because the real interest in this type of position is to see Bitcoin break above or below one of the two levels mentioned above. And in this case, it is upwards that the situation could be more explosive.. A large number of liquidations could happen as soon as the $31.000 mark is crossed, quickly pushing BTC towards $36.000. On the other hand, we should wait until the $23.000 mark is reached before the situation becomes clearer.

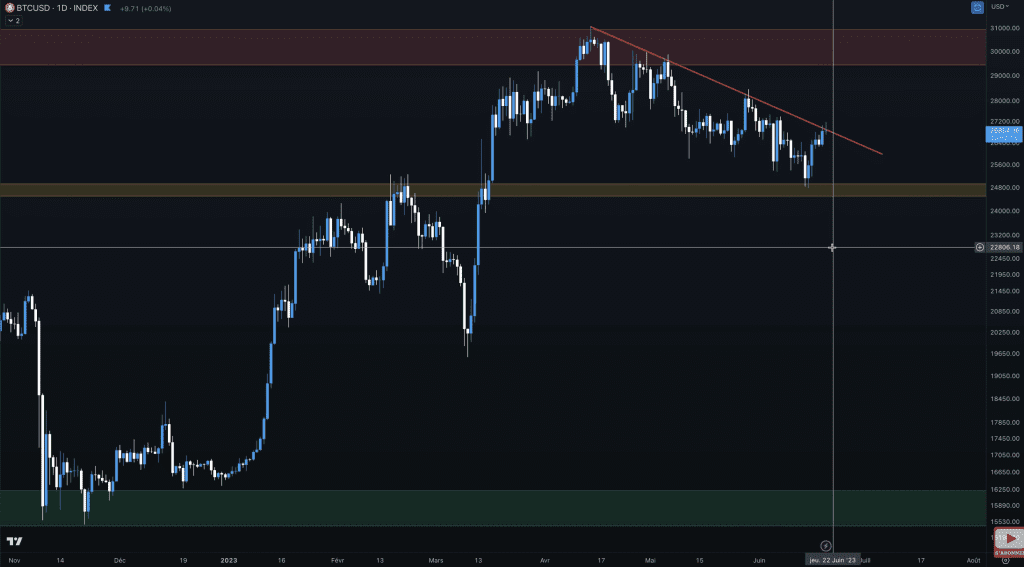

Bitcoin – Downtrend does not mean trading impossible

The Bitcoin market remains bearish in the short term. But we can see that if this trend accelerates, there will be several hurdles to overcome, such as the $23.000 level at first, then the $22.000 level… Which means we can expect quite a slow move in this direction.

On the rise no obstacles appear to be preventing Bitcoin from quickly heading towards $36.000whether its current resistance at around $31.000 is broken. But for the moment this is out of the question. BTC looks set to bounce once again off the short-term downtrend line drawn on its daily chart. But in the event of a breakout, it could easily make a small and very lucrative 15% gain, even in this type of market setup…

You'd like it experience cryptocurrency trading with confidence ? The application cryptotrader it allows you to take positions at the best moments to make this experience very profitable even in uncertain or apparently neutral market configurations. Plus, you can still take advantage of his RARE offer: "Profitability guaranteed or refunded. " Sign up for their newsletter to make sure you don't miss out on this opportunity…

Cryptocurrency trading carries a high level of risk and may not be suitable for everyone. It is recommended to be well informed about the associated risks and to invest only the sums that you can afford to lose.

The content provided on the CryptoActu.com site is for educational and informational purposes only. It does not in any way constitute a recommendation and cannot be assimilated to an incitement to trade in financial instruments.

The CryptoActu.com site does not guarantee the results or performance of the financial instruments presented. Consequently, we decline all responsibility for the use that may be made of this information and for the consequences that may derive from it.