Contents

This has also forced governments to review these exchanges to stop any potential illicit activity and to "protect" investors. Furthermore, banks have begun to take action since they experienced large capital outflows from people who wanted to invest in cryptocurrencies.

When you combine the fact that governments are starting to attack some exchanges, in particular Binancewith the fear that banks have of losing customers results in a not-so-good situation for cryptocurrency investors. Now that governments are implementing cryptocurrency rules and some are speaking very negatively about it, it has allowed banks to cut their customers off cryptocurrencies.

Many noticed this when the crackdown on Binance led to numerous banks restricting bank transfers and payments to and from Binance. This is why there is now an extensive search for cryptocurrency friendly banks to use for a secure bridge between cryptocurrencies and fiat. Fortunately for us, there are a lot of them and we will look at some of them in this article.

The importance of a good exchange

Before discussing which bank is best for cryptocurrencies it is important to note that if you are using the wrong exchange it may not make any difference which bank you use, you may still be left without a way to withdraw or deposit. This is partly what happened in the whole Binance situation.

Il Binance's crackdown it started because Binance did not have the necessary licenses to operate in the jurisdictions it was already operating in. Of course, it is illegal to operate without the necessary licenses, and understandably, no matter which bank you are, it is not good to do business with an illegal entity. Yes, it may not have been that dramatic and many banks have allowed you to deal with Binance, but in a more extreme case, you could be in trouble if you use the wrong exchange.

The entire Binance crackdown started in the UK and led to banks like Barclays, HSBC and Santander restricting payments to Binance.

Also, one of the most used forms of money transfer to an exchange in Europe is SEPA transfer, which is something that can be limited. SEPA is an EU initiative and not just a technical term. This means that when regulators want, they can stop SEPA transfers to a certain asset and there's nothing your crypto-friendly bank can do about it.

As you understand by now, you need a good exchange. The surest way to make sure you always have the option to withdraw your funds is to use one of the large centralized exchanges. I understand it's not an option for those who prefer the privacy that comes with decentralized exchanges, but it's still worth considering. If you are now wondering what the good ones are then it's your lucky day, you can find a video on the best regulated exchanges since coin bureau Youtube channel.

Stay away from boomers

Before going into every single bank, there is one interesting thing that connects most crypto-friendly banks. They are all digital, new and innovative.

When I searched the internet for crypto-friendly banks, I found a lot of content. Many sites highlight the same banks as the best even though many of them weren't that familiar. They were also relatively new to the traditional banks we are used to seeing everywhere like Barclays, HSBC, Santander, JP Morgan, and other high profile options.

New technology is coming, and our big banks don't seem ready for it.

There are many reasons why this is the case, and many of the reasons are similar to why people own or don't own cryptocurrencies in the first place. For banks in particular, cryptocurrencies are often seen as a threat as one of their primary use cases is to remove the middle man, which is often the bank.

One might therefore wonder why these digital banks want to implement cryptocurrencies? Well, we have to face the fact that fiat currency will not disappear, and will likely continue to be the form of currency used by the majority. This is why these digital banks see a way to capture the customers of big banks by being the first to offer a friendly view of new technology, building bridges between the old and the new.

So why don't the big banks want to be the best at this too? This is where I would say the more traditional reasons come into play. Many of the boards of the big banks are full of older people who don't understand, nor want to understand, the use case of cryptocurrencies. The amount of innovation is very different in a start-up bank than in a bank that has operated in much the same way for centuries. Many banks also lived in the hope that cryptocurrencies would die, but as we can see, cryptocurrencies aren't going anywhere.

The transition to a mobile-centric lifestyle has paved the way for new digital-only banks.

Due to all of this it should be noted that the banks found in this article are not the traditional ones you are used to seeing. However, this shouldn't stop you from giving it a try. It's also worth noting that just because you're looking for a crypto-friendly bank doesn't mean you have to move all your business from one bank to another. It might just be a good idea to set up one of these more crypto-friendly banks to manage your crypto investments. You can still keep your main account somewhere else and use it for all things other than cryptocurrencies.

The most friendly banks of cryptocurrencies

There are a few things to remember when reading this list. All of these banks may not be available in your country of residence and therefore may be irrelevant to you. Also, these banks are just some of the options out there so don't limit your search to just these. Finally, these banks are not classified in any particular order.

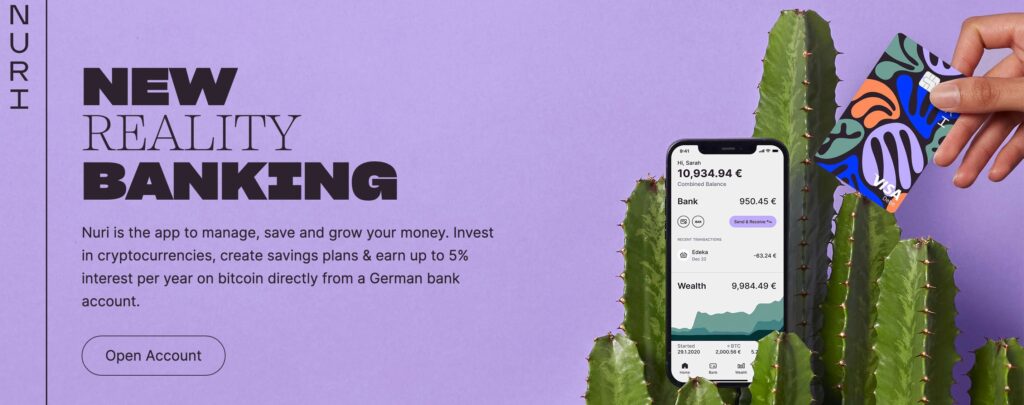

1. Nuri

Now that we've covered some more strictly available crypto-friendly banks, let's move on to a larger, more widely available bank. Nuri, formerly known as Bitwala, is a Germany-based bank available to everyone in the EU, UK, Switzerland and many other jurisdictions.

Grow your money by investing and saving in cryptocurrencies and start earning up to 5% interest per year on Bitcoin. All directly from a German bank account, including Visa debit card.

Main features

- Complete German current account with deposit guarantees of 100.000 euros

- Visa debit card with unlimited and free ATM withdrawals

- Crypto Wallet, Buy & Sell Bitcoin / Ether & Bitcoin Interest Account

- Secure wallets and vaults for cryptocurrency storage

- Free annual tax report

- Customer support via Chat & Email

They have partnered with Solarisbank to host their accounts, which makes deposits of up to € 100.000 insured. As for the fees, opening an account is completely free and there are no management fees. The only commission you will encounter is a 1% trading commission.

Nuri could be your all-in-one solution for dealing with cryptocurrencies. Image via Nuri.

One of Nuri's best features are their savings plans. Nuri believes that saving and investing in cryptocurrencies shouldn't be a chore, so they make it as easy as possible. In fact, they allow you to automate your Bitcoin and Ethereum purchases, making them a typical part of your routine. Just set up recurring payments and Nuri will automatically buy a certain amount of Bitcoin and / or Ethereum every month.

The Bitcoin Savings Account pays up to 5% APY and comes with the following benefits:

- Weekly payments directly to the Bitcoin interest account every Monday

- No blocking, add & camp; withdraw at any time

- Withdraw and convert to euros in minutes

- Minimum investment of 10 euros

- Only network fees apply when investing, no additional fees for withdrawals

What makes this even better is that it harnesses the power of dollar-cost-averaging. This means that when cryptocurrency prices are lower you buy more Bitcoin or Ethereum, and when they are higher you buy less. Over time this nullifies the volatility and price changes of your crypto purchases and gives you the best long-term results.

When it comes to cryptocurrency friendship, Nuri is big. Through them, you can buy both Bitcoin and Ethereum directly. Plus, they offer up to 5% interest on your Bitcoin holdings, which is quite large considering you're doing it through your bank. All of this proves that Nuri is a crypto-friendly bank and probably won't limit your payments to cryptocurrency-related businesses.

2. Bank Fidor

First, let's start with a bank that has since 2014 proceeded to be a top choice for crypto enthusiasts. Fidor is a digital-only bank based in Germany that currently only operates within Germany. However, as they are undeniably one of the most crypto-friendly banks, they need to be mentioned. Fidor is also easy to set up and the fees aren't that bad. Fidor's fees are € 5 per month, but can be offset if you make more than 10 transactions per month.

A bank worth considering if you are German. Image via Fidor

In 2014 Fidor partnered with a popular German exchange called Bitcoin.de. This allowed their clients to almost instantly deposit funds to buy cryptocurrencies. Today they also have a partnership with Kraken and are Kraken's fund providers, which makes this bank an obvious choice for anyone living in Germany and using Kraken. Since they have direct partnerships with cryptocurrency exchanges, it is highly unlikely that they will suddenly freeze your cryptocurrency transactions.

3. Monzo

Now, as the previous bank is only available to residents of Germany, it's only fair to bring one that is only available to UK residents. As with Fidor, Monzo is also a digital-only bank, so you need to be comfortable using your mobile device. An extremely positive benefit you get from Monzo is zero card payment fees. There are really no fees for card payments, not even overseas, plus their basic account is free.

A great choice with a proven track record.

What sets Monzo apart as a crypto-friendly bank is that during the Binance crisis in June / July 2021, where many banks stopped deposits at crypto exchanges, Monzo let his clients know that he will continue to support transactions at exchanges. of crypto. However, there were, and still are, some exchanges that they don't support, but that's reasonable since, as mentioned, it's not good to support something illegal.

4. Revolution

This is another digital-only bank. Revolut is considered by many review sites to be the most crypto-friendly bank out there. They have over 15 million customers worldwide, as they are available to customers from all major countries such as the UK, the US, most of the EU and many more.

Revolut is also extremely easy to use and set up, especially compared to traditional banks that require piles of cards. Revolut just asks for some personal information, including a selfie, and after that it's simple to order a Visa card through the app and you're good to go. And yes, all of this is free.

A large bank with a large customer base and a quality platform.

The reason Revolut is seen as a crypto-friendly bank is because they offer the ability to buy cryptocurrencies with their app. A while ago they were criticized for not allowing cryptocurrency withdrawals, but this is now available for wallets like Ledger.

However, buying cryptocurrencies with Revolut may not be the wisest thing. Revolut has a base fee of 2,5% and an additional 0,5% if you trade more than 1000 pounds. The only way to lower the fee is to upgrade to premium or metal accounts, but this will cost you £ 6.99 or £ 12.99 by only lowering the base fee to 1.5%.

Therefore, even though all the development that Revolut is doing in the crypto space is extremely good, it may not be the best idea to use them for crypto trading. However, as with some previous banks, all of this shows that this is a bank that is far less likely to limit your business in the crypto space than many others.

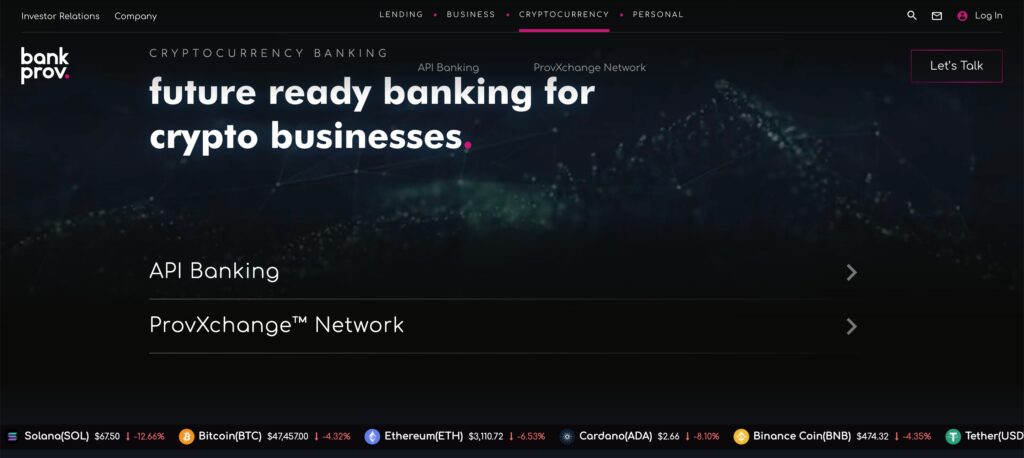

5. BankProv

Although I mentioned earlier that as a general rule older banks are less likely to be crypto-friendly, there are still exceptions. BankProv, formerly known as Provident Bank, is over 200 years old, making it one of the oldest in the United States. BankProv is a publicly traded company under Provident Financial Holdings, and this may give you some overall security. Today BankProv is advertising itself as a leader in FinTech and without knowing the history you might think it is a startup. This is at least the feeling I got upon entering their website.

While this list has been more about personal banks, this is more of an investment bank. BankProv offers personal accounts but their business opportunities are much better exposed.

It's worth a look if your business needs a good crypto-friendly bank. Image via BankProv.

What makes BankProv crypto-friendly is its cryptocurrency segment. When you look at the website you will see cryptocurrencies as a category of their own. Here they offer API Banking along with ProvXchange Network. These guarantee instant transfers within BankProv's customer network.

The banking API is also known as open banking, which means that you are guaranteed access to your data at all times. They also have a partnership with Anchorage Digital to offer cryptocurrency-backed loans. The latest announcement was to offer Ethereum-backed loans. It would therefore be logical to assume that a bank offering crypto-backed loans will not stop your interactions with crypto exchanges or other crypto companies.

6. Wirex

Even though Wirex is on many more crypto-friendly bank lists, it's actually not a bank. However, it is worth mentioning, as as they state on their website, not being a bank allows them to do things that banks can only dream of. Wirex has their own payment card in partnership with Mastercard, and they advertise it as more advantageous than Monzo or Revolut cards. Wirex has three different plans with the basic free one. If you upgrade your plan you will get more crypto back which, if you use the card a lot, could pay off the price of the plan.

Not quite a bank, but a great option to use for your crypto-related stuff.

The reason Wirex is mentioned on so many lists, even if it's not a bank, is that it supports cryptocurrencies while still offering the same traditional features as banks. They offer a multi-currency exchange that includes many traditional currencies along with a large selection of cryptocurrencies, at least compared to their competitors. Since I'm not a bank, the process is almost instant.

Wirex also has its own token (WXT) which if you own you will have more opportunities to use DeFi along with other features related to cryptocurrencies. This makes Wirex perhaps more of a Crypto.com-like exchange, but it's still worth checking out. Another popular and safe similar option would be Paypal which recently rolled out its cryptocurrency offerings to UK customers.

Conclusion

One important thing I want to point out once again is that these banks weren't in order and there are numerous other good options out there. If you find any other banks that you think might be crypto-friendly, I recommend that you check the company news. If you see partnerships related to cryptography then you should be good to go.

Many banks are becoming more crypto-friendly as they need to do this if they want to keep their customers. That's why I wouldn't worry too much if your bank doesn't offer the opportunity to buy crypto directly, as long as they have a part of their business related to crypto-related services then you should be okay.

As I have also mentioned before, there is no need to change all your business from one bank to another. Many of these digital banks may not offer the same deposit guarantees as some of the large banks, and you may not be comfortable with this if you have large sums of money.

There have also been many accusations against the lack of security in these digital banks. Therefore, you can very well just change your cryptocurrency-related stuff at one of these banks, leaving your traditional fiat assets in the old place. In this way you guarantee the best security combined with flexibility.

Furthermore, as time goes by I strongly believe that even the most anti-crypto banks must change and adapt to the changing world. This means that even the banks that are now trying to limit your crypto transactions will have to change or else they won't survive.

Disclaimer: These are the writer's views and should not be considered investment advice. Readers should do their own research.