Contents

Bitcoin superforms in January (within 3 days): +40%.

Indeed, the leading cryptocurrency may not only achieve the best monthly performance since October 2021, but it could also they rank alongside January 2013 in terms of 30-day progress, 40% increase from 51% a decade ago.

The context of a weakening dollar has a lot to do with this phenomenon. Especially if we relate it to the provenance of the buyers, who are more active on the other side of the Atlantic, according to the well-founded observations of official market observers.

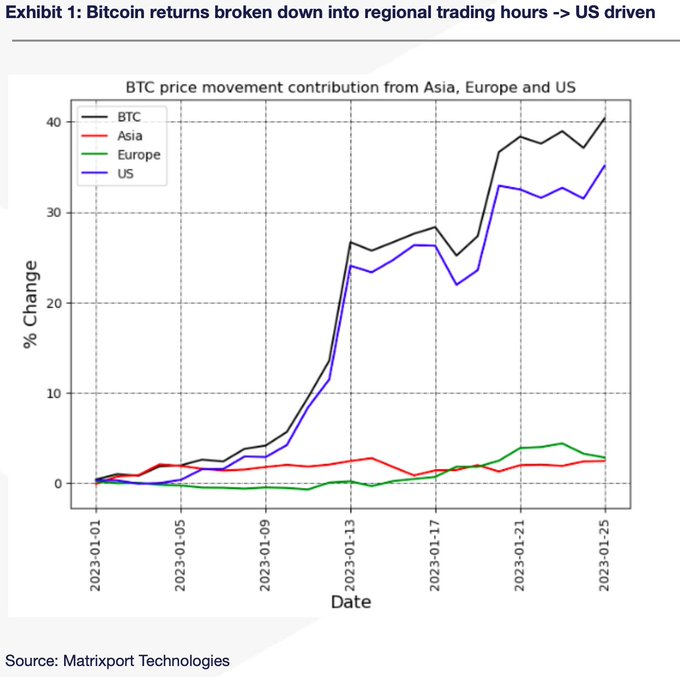

In fact, the latest weekly report of the cryptocurrency financial services company Matrixport notes that the heavy investments in BTC were made during trading hours in the US, accounting for 35% of the documented 40% increase. So, according to the report, US investors are estimated to have contributed 85% of bitcoin's bullish rally.

Even better, Matrixport identifies most of them as institutional.

The institutions are coming back

In support of his thesis, he claims that in their weekly observations, his experts have found that for an asset that trades around the clock, it is easy to distinguish between individuals and institutions.

If [the actif] If a company does well during US business hours, it is assumed that US institutions are buying it. If the asset performs well during Asian trading hours, it is more of a signal that individuals are buying it.(…) Therefore, we interpret this as a clear signal that US institutions are currently buying Bitcoin.

Matrixport at Twitter

This inference is supported by other evidence as noted by Coindesk, including thel positioning on BTC futures contracts three-month futures contracts listed on the Chicago Mercantile Exchange (CME). Considered a proxy for institutional activity, they are trading for the first time since the fall of FTX with a slightly positive premium (+0,2%).

Coinbase's premium also turns positive

Furthermore, Coinbase's premium, which measures the spread between Coinbase's BTC/USD pair and Binance's BTC/USDT pair, veered higher according to the Coinbase Premium Index by CryptoQuant. Further evidence that skilled investors have leapt into action is that theexchange is their platform of choice, while Binance remains the stronghold of retail.

If the signals start to align to suggest an end to the bear cycle – which of course does not mean a bull market recovery, just that the lows have been reached -, the macroeconomic context calls for caution. The Federal Reserve, whose next meeting will be held on Wednesday, did not, as usual, provide any indication of its intentions regarding the continuation of monetary tightening. A further crackdown and bitcoin could meet another bad end, pushing institutional investors towards less risky asset classes.

Liability disclaimer: This article is about the latest cryptocurrency news. This is not investment advice. Any position taken must be accompanied by a personal research and requires the crossing of several sources before intervening. DYOR!