In an industry already battered by the harsh cryptocurrency winter, the FTX / Alameda disaster could lead to an acceleration of layoffs.

The fall of the FTX empire could lead to waves of layoffs

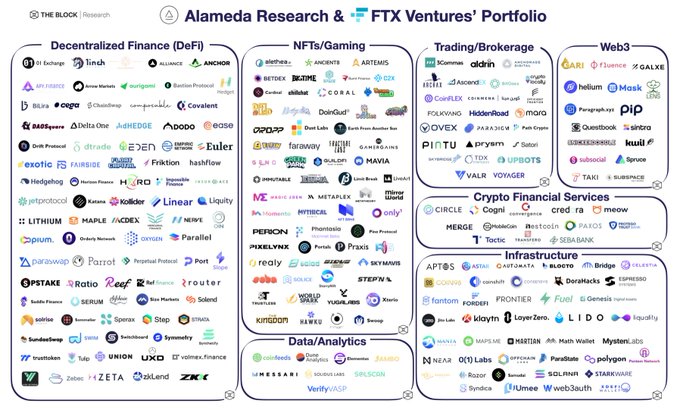

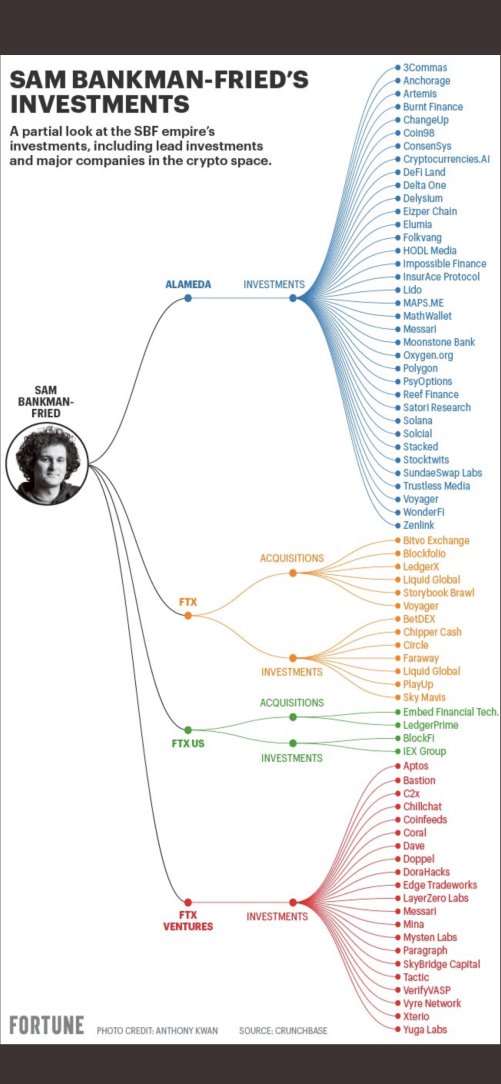

Already downsized in several companies in the sector due to the market downturn, employees of the cryptocurrency industry could see a new wave of layoffs due to the implosion of a major exchange and its subsidiary Alameda Research. These Siamese companies, whose nauseating degree of collusion continues to be revealed In the past, these companies were closely linked to an impressive number of industry players.

Information that may only be partial, but which gives an idea of the extent of the damage, especially since an unknown number of companies in which Alameda had invested were forced to keep their cash on FTX. A condition that is often found also in conventional finance and which is the cause of the famous "systemic collapses".

In this perspective of potential contagion, a relationship of the leading cryptocurrency site CoinGecko reveals that as of November 13 4.695 industry employees went on strike since the beginning of the year, but others may be forced out.

With the collapse of FTX on November 6 and its full impact on the cryptocurrency space still underway, more cryptocurrency layoffs could occur in the coming months.

Relationship by CoinGecko

A domino effect with the power of X

We have reported many times of those crypto companies that are firing or re-firing. And many of them weren't new, like Coinbase (2012), which just did it again. with 60 other employees. But there is also Gemini (2014) that has Furthermore, thetwice taken Crypto.com (2016)… each of which cited a particularly severe "crypto winter".

A debatable argument, given that they are not in their first cycle of descent.and that, if the fall in the price of Bitcoin is a fact, it has already been through worse, "settling" for the moment with a -74,5% from its peak (ATH) and in 2014, its price had dropped by 86%. from its historic ATH of $ 1.177 e in 2018 by 84% from its peak à 19 764 $. It is difficult to believe that all these platforms have let themselves be carried away by the euphoria of a bull market, sinning with optimism and myopia like the "blues".

Obviously, there have been management errors that the "little hands" of the sector are now paying for. But not only. The collapse of the Terra Luna ecosystem in May, which brought with it the failure of large entities such as Three Arrows Capital Fund which particularly affected Blockchain.com (2011), which has given it as a justification for its downsizing, portends a devastating domino effect that could repeat itself in a much more intense way with FTX that will become inevitable over the months.