Contents

On the momentum of last Wednesday, Bitcoin has finally managed to get out of the side congestion zone around $ 20.000. A technical situation that would confirm a temporary halt of its bear market since the last ATH in November 2021. Furthermore, the rise in equity indices combined with the decline in commodity prices since mid-June would suggest that the peak of inflation is now behind us .

Should this scenario materialize, the Fed could ease monetary tightening slightly. This would prolong the technical rebound in BTC prices. With potential that seems far from being consumed. As a result, sellers would likely prefer to pull back in anticipation of a clearer picture, thus giving way to buyers who are tired of running in circles for several weeks.

Bitcoin - Best week in a long time

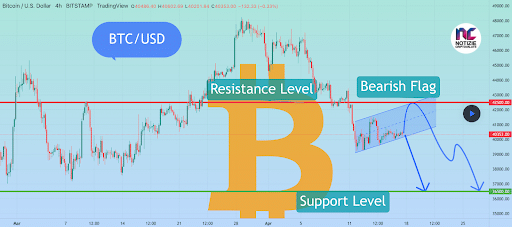

If we want to leave it as it is, Bitcoin would have its best week since it failed to break through the $ 46.000 resistance. Even better, the threat below the $ 20.000 support would recede, at least in the short term. To such an extent that the current moment indicates a remontada close to nearby resistances. Starting at the $ 26.000 level, that would be within reach.

In the wake of this recent momentum, technical indicators are getting a makeover. On the one hand, the MACD is reported as close to crossing the bullish signal. On the other hand, the RSI has just exited the oversold zone. A continuation of their recovery would encourage BTC prices to rise to $ 26.000. Enough to approach the descending line since the last ATH in November 2021.

Assuming a continuation of the technical rebound, Bitcoin could attack the $ 30.000 threshold.one of the main of the last running of the bulls. The only condition is that there is a short-term turnaround across all risky asset classes, as appears to be the case since mid-June.

But for all of this, this bullish correction scenario would not stop Weinstein Phase 4 and shoulder-head-shoulder (SHS). With the 30-week moving average (weekly MM30) continuing to slide, the former is solidifying more than ever. As for the latter, its neckline around the $ 41.000 threshold remains far from current prices. Hence the belief that a favorable turnaround will remain highly hypothetical over the course of this year.

Bitcoin - Triple Fund Validation

If we are seeing the best week for Bitcoin in a long time now, it makes sense that the technical analysis in daily units is good. Indeed, prices validated a triple bottom by breaking the $ 22.000 resistancewhich now becomes a support. Especially since this favorable technical signal comes at a time when the MACD and RSI have crossed their respective waterlines.

The fact that both technical indicators are not overheating suggests that the technical rebound would still have some upside. For this reason, BTC prices could reach the $ 30.000 resistance if they manage to tame the $ 26.000 resistance as a first step.

Given the high beta of Satoshi Nakomoto's digital currency since it has existed, everything would seem conceivable. provided that hopes continue to ease the current uncertainties in the financial markets.

BTC - Finally a break in the bear market!

Investors are eagerly awaiting a break in the Bitcoin bear market since the last ATH in November. He's here to ease the stigma of a killing spring. However, if they see the end of the tunnel, they better not want the end of the tunnel. We remain on a technical bounce scenario until prices move towards yours again gammathat is, above $ 35.000.

In this case, Sellers will surely be watching the $ 30.000-35.000 area to take over. If so, they would trigger a third downward wave, which would in turn be under the sign of capitulation, the final stage of the bear market. With the fear of seeing a new landing towards $ 20.000 or even below the $ 12.000 supportthe critical level of the last bull run.

But if by chance, prices were to return to gammathe BTC bear market would be momentarily neutralized. And to make sure we start off on the right foot, it would be imperative to go back to the $ 41.000-46.000 price range. It is clear that there is still a lot of work to be done to imagine this dream scenario, given the market context in which we find ourselves.

Cryptocurrency trading carries a high level of risk and may not be suitable for everyone. It is recommended to be well informed about the associated risks and to invest only the sums that you can afford to lose.

The content of the NotizieCriptovalute.it website is for educational and information purposes only. It does not constitute a recommendation and cannot be considered an incentive to trade in financial instruments.

Cryptocurrencynews.it does not guarantee the results or the performance of the financial instruments presented. Therefore, we assume no responsibility for the use that may be made of this information and for the consequences that may derive from it.