After the difficult week and the FTXIt's been ten days since Bitcoin it shows no trend and remains flat, waiting for more positive news. Technically, the limit is not far off, but the support still holds.

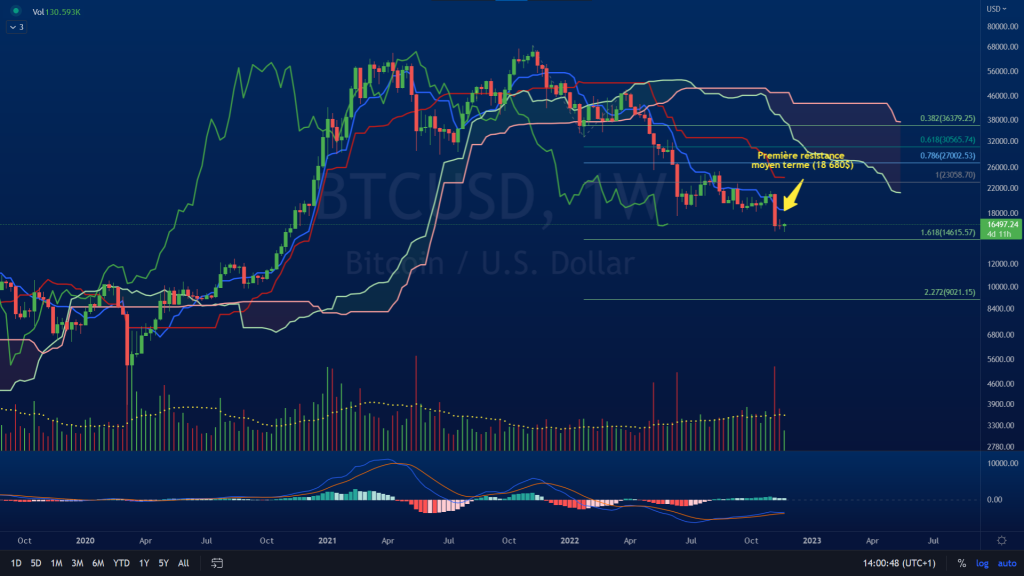

Bitcoin – Weekly chart: buyers at half-auction

It's been two weeks since the violent sell-off following the FTX affair. Two weeks without major trends e decreasing volatility. Buyers are stunned, sellers stand their ground, in short, a situation that is evolving without a trend.

The backdrop obviously remains bearish, with a Tenkan weekly at $ 18.640 which will act as resistance if prices decide to attempt a rebound. Note, however, the divergence of the MACD indicator from the prices. A hint of a possible end to this endless fall ?

Finally, a The Elliot wave count indicates a possible end of the downtrend. With a five wave build targeting the $16.000 area. Also here, a first clue will be given by an upward break of the weekly Tenkan.

Bitcoin - Daily chart: the beginning of a rebound?

Il Bitcoin it has withstood several onslaughts from sellers and from the $15.880 area continues to resist. The sellers hold their positions and wait for a break below this level to strengthen their orders.

Today, Wednesday 23 November, prices are breaking the daily Tenkan at increase. If it closes above this value, it will be a boon for the buyers. With a first target at $18.500. The current construction suggests this scenario, with 15.880 as main support and 14.600 as last resort..

Note that the The MACD is about to give a buy signalwith a possible bullish moving average crossing. This signal will confirm the willingness of prices to go back to testing the old technical support, which had held up so much for several months...